The National Communication Authority (NCA) will soon be calling for public consultation on four new telecom industry license categories, one of which is the single Interconnect Clearinghouse License, intended for a number of purposes including serving as a national firewall against a number of industry frauds.

Cabinet has sanctioned the announcement for public consultation on the four license categories and currently high level industry consultation is ongoing, pending a wider publication consultation later this month to discuss the implementation timelines.

The four license categories are Unified Licenses (for all telcos to have fixed line operations), three MVNO (Mobile Virtual Network Operator) licenses, three International Wholesale Transit (IWT) licenses and finally one Interconnect Clearinghouse (IC) License.

Whereas all the four license categories are important, of key interest to industry players is the interconnect clearinghouse license.

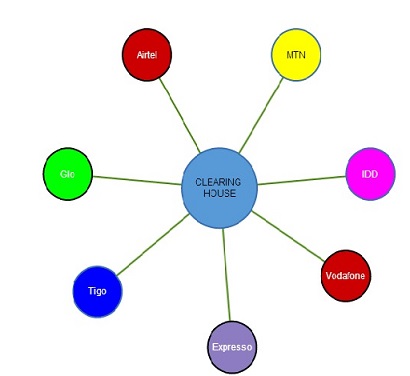

The license would create a one-stop-shop interconnect clearinghouse where all communication within the country and from overseas into the country would go for clearance before terminating on the intended network. The spectrum of communication which would go through the clearinghouse include calls, SMS and even data communication.

Apart from linking all the telecom networks in the country at one point, the clearinghouse would also link all internet exchanges and serve as the operator that mandates all traffic as legal before that communication is allowed to continue to the intended network or customer.

Effectively, it would be the connection point between telco, ISPs, Value Added Service VAS providers/app developers and international traffic carriers.

A similar player exists in Nigeria, but it is not compulsory for telecom players in that country to connect to it. But this writer can confirm that the one being proposed for Ghana would do more than what the Nigeria one does. And it would appear that industry players would be compelled to connect to the clearinghouse in Ghana because of the spectrum of services it is intended to provide.

Very often, telcos and their VAS providers send communication (SMS, ringtones, etc.) to people who have not subscribed to such services and charge them for it. But with a clearinghouse in place, such communication would be barred from reaching people who have not subscribed to them.

It is also very common to find fraudulent text messages and or calls from overseas phone numbers and messages on social media platforms like WhatsApp, Facebook and others requesting recipients to perform some action. Responding to such messages could sometimes cost the recipient dearly.

But the clearinghouse, working as a firewall, would sieve out such unwanted messages and prevent them from entering into the gateways of the country, much less hitting any mobile network and getting to customers.

The clearinghouse would be a private telecom service provider and would also be regulated by almost the same regulations that apply to other industry players. It would be required to meet the laid down quality of service standards and other regulatory requirement and be penalized when they fail on any of those.

SIM Boxing

Ghana has been grappling with the lingering menace of SIM box fraud, where some fraudsters here and abroad route calls from overseas through the internet and terminate them through local SIM cards fitted into devices called SIM boxes. That way they create the impression those calls were generated locally, so they pay only local rates and rob the country of huge sums of money.

But to the extent that all those calls come from overseas, a national firewall, in the form of the interconnect clearinghouse would bar such fraudulently routed traffic from entering the country.

So the overseas carriers who give traffic to SIM box fraudsters to bring to Ghana will have problems if they do not use the approved routes, i.e. the gateways of the telcos and any approved private international wholesale transit (IWT) operator.

Kenya has a national firewall, which prevents calls from abroad going through unapproved routes from entering into that country. So SIM box operators do not find Kenya attractive, even though the telecom industry in Kenya is very big.

But in Ghana, the industry regulator, NCA has been pushing telecom operators to establish systems on their own to fight SIM boxing, and it has not worked so far.

NCA tried to do real time monitoring of telcos international gateways through a private company called GVG (Global Voice Group) from Haiti. But it was not clear how that was going to stop SIM box fraud, since there was no talk about the monitoring systems also working as a firewall.

But the coming clearinghouse is said to have presidential backing and is therefore a national policy, other than just a project by the NCA, to ensure sanity in the system and to also prevent fraud originating both here and abroad in the telecom space.

VAS providers

The telecom operators have been duly informed about the clearinghouse and the other licensing categories, and some of them have issues with its implications for their respective businesses. But they shy away from making public pronouncement on it until actual implementation.

However, their VAS partners seem to be very glad about the clearinghouse because the net benefits to the VAS industry in Ghana are vast.

Chief Operating Officer at TXTGhana, Eyome Ackah, who worked with almost all telcos in this country before joining the VAS industry believes the interconnect clearinghouse is a fantastic idea because it would inject some regulatory regime into the telco-VAS players relationship and also stop the telcos from bluffing the VAS players.

“Currently we deal with telcos purely on relationship and so they can decide to bluff or cut you off as a VAS player if they are not happy with you. But I believe that relationship needs to be properly regulated so that the telcos would not be able to bluff,” he said.

He noted that with the clearinghouse onboard, VAS players would just have to go to the clearinghouse for connectivity to all telcos at a go before going to each telco to talk business based on the new regulatory regime.

Eyome Ackah said the clearinghouse system is expected to inject some regulation into the VAS revenue share arrangement between telcos and VAS providers.

“Under the telcos interconnect regulations, if a call originates from telco ‘A’ and terminates on telco ‘B’, telco ‘A’ is supposed to pay telco ‘B’ a specified amount of 5Gp per every minute of that call. But with VAS, the telcos unilaterally decide what to charge and the VAS providers have no say. And they take between 55% and 70% of the revenue,” he said.

General Manager of MobileContent, Conrad Nyur said regulation under the clearinghouse arrangement is important because it promises to kill the way telcos unilaterally decide on what percentage of the revenue they took without recourse to the views of VAS providers and content owners.

“They often tell us the share they take is based on orders from their mother companies abroad. I think that is unfortunate because those mother companies do not work in Ghana so they do not know what pertains in our economy,” he said.

Nyur however believes the best purpose the clearinghouse could serve is to be a firewall against fraud, particularly the ones being perpetrated by unregistered VAS players and individuals both in Ghana and overseas, sending communications into the country without any restrictions.

General Manager of SMSGH, Alex Adjei Bram believes some of the work of the clearinghouse is already being done by telcos and some VAS providers, but the one-stop-shop clearinghouse idea is not a bad one to the extent that it would ensure sanity and organization in the system.

“We came together to form WASPAG (Wireless Application Services Providers Association of Ghana) for the purposes of self-regulating to clean up the abuse in the system, but I believe when the clearinghouse comes in the work will be much easier because it will serve to prevent any such abuses at one point and save us the headache,” he said.

Adjei Bram also believes the clearinghouse would bring organization into the VAS/telco relationship because even customers wanting to stop a service from a particularly short code or service provider would just have to go to the clearinghouse and give one instruction.

“It would also streamline several of the industry processes that otherwise involved various stages of implementation by different bodies,” he said.

Adjei Bram also thinks the clearinghouse would take care of some of the equipment some telcos invest in specifically for VAS services, adding that “when that happens the telcos will spend less and therefore feel comfortable to adjust the revenue share arrangement so that the VAS players and content owners could get a lot more of the money to share.”

He described the current VAS revenue share arrangement as “a dumper on the industry”, saying that an adjustment in favor of VAS players and content owners will be “the greatest heaven.”

Questions

Meanwhile, questions are being asked of the implications of the clearinghouse to the industry. First of all, telcos already have automated interconnect arrangement which is working fine so far, so questions are being asked as to why a telco should be compelled to a separate clearinghouse.

Secondly, what would be the cost implications of the private clearinghouse to telcos, which have already invested in their existing and effective interconnect systems – and what happens if the interconnect clearinghouse holds up interconnect fees belonging to telcos, just like what is happening in Nigeria, where the clearinghouse owes telcos?

Thirdly, an alarm is being raised that connecting all internet exchanges to a clearinghouse could mean monitoring and censoring of the internet communications including private emails, which could infringe on people’s freedoms on the internet. It brings up the term ‘North Korea’ in the minds of pundits. Some have even suggested that the interconnect clearinghouse is simply ‘evil’.